Sponsored

Summit Sotheby’s International Realty: 2021 Year-End Market Report

One of Summit Sotheby's many stunning luxury properties in and around Park City. Photo: Summit Sotheby’s International Realty

PARK CITY, Utah – Summit Sotheby’s International Realty’s 2021 year-end Market Report explores Utah’s current and historical real estate market conditions for the Wasatch Front, Wasatch Back, and Southern Utah areas.

US Economy

The US economy grew by 5.7% in 2021, the strongest since 1984, forging ahead despite headwinds from the pandemic, strained supply chains, as well as inflation. In 2020, the US economy had reduced by 3.4%, the biggest decline in 74 years. The gross domestic product (GDP) increased at 6.9% annualized pace in December, the strongest growth rate in nearly four decades, and above most analyst projections. The fourth quarter was characterized by business replenishing depleted inventories to meet strong demand for goods. Inflation is the highest it’s been in 40 years, clocking in at a 7% rate year over year, the fastest since the second quarter of 1981, and way above the Fed’s 2% target. And the Fed has signaled that multiple rate hikes will be used to rein in inflation in 2022.

US Real Estate Market

The residential housing market is a sizable chunk of the US GDP, roughly 5%, and demand for housing is still strong. The national median home sale price was up 15.2% year over year to $382, 840. The 30-year fixed mortgage rate has risen to 3.55% with three additional rate hikes by the Fed expected this year. Most analysts expect the 30-year fixed mortgage rate to be close to 4% by the end of 2022. Rent is rising as well, with Multifamily Residential Apartment asking rents up to 11.3% year over year on average in the past 12 months. Prior to the pandemic in 2020 Q1, apartment rent were raising by just 1.6%. Investment in homebuilding contracted for three consecutive quarters to end out 2021. The sector is still being constrained by costly building materials, which has resulted in a record backlog of homes yet to be built.

The Utah Market

Utah is becoming a magnet for in-migration, many looking to improve their quality of life and enjoy the lower overall cost of living. Realtor.com has ranked Salt Lake City as the number one housing market poised for growth in 2022, projecting a 15.2% year-over-year increase in sales and a further 8.5% increase in prices. Utah also boasts the nation’s strongest pace of job growth and record unemployment.

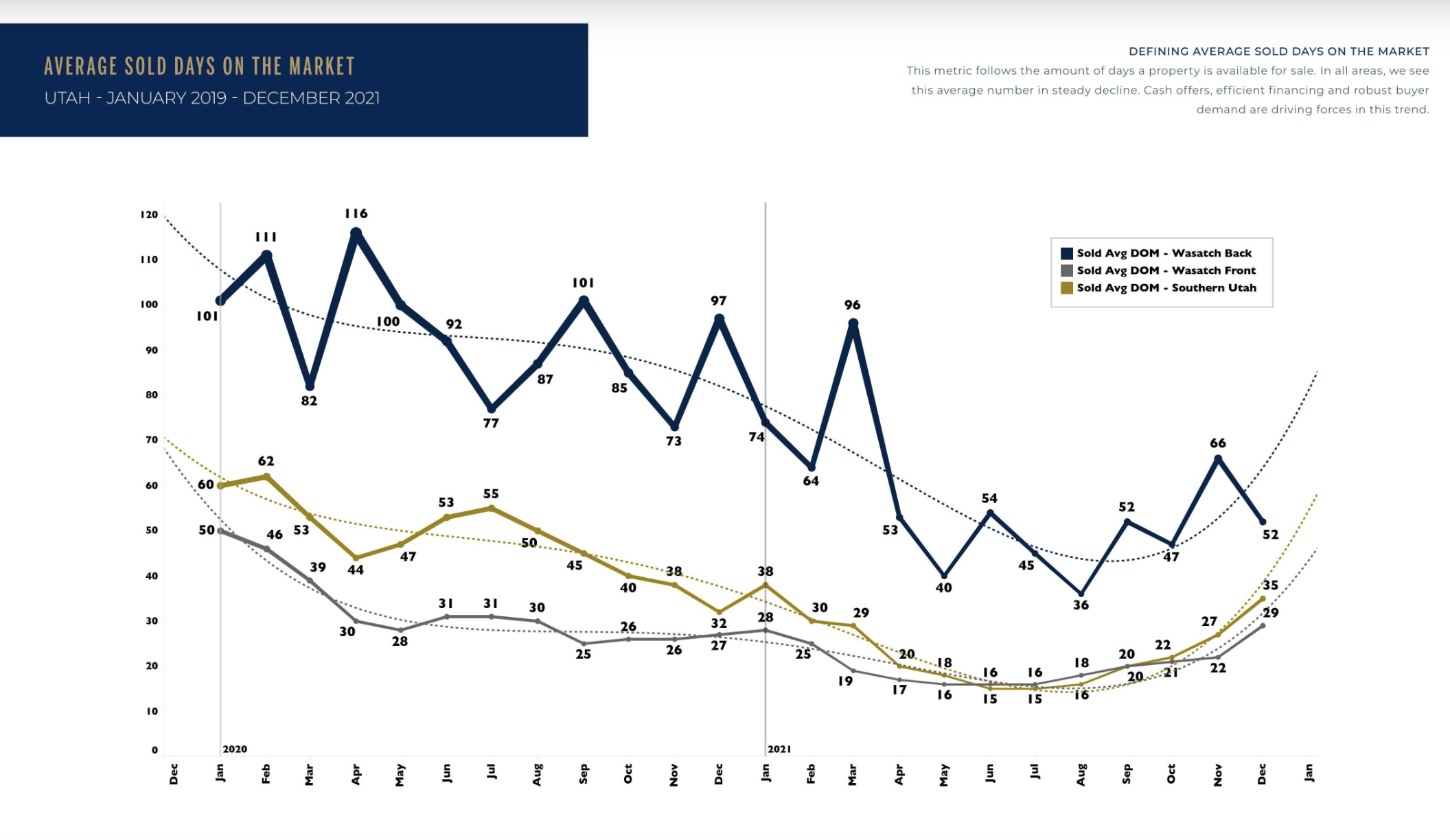

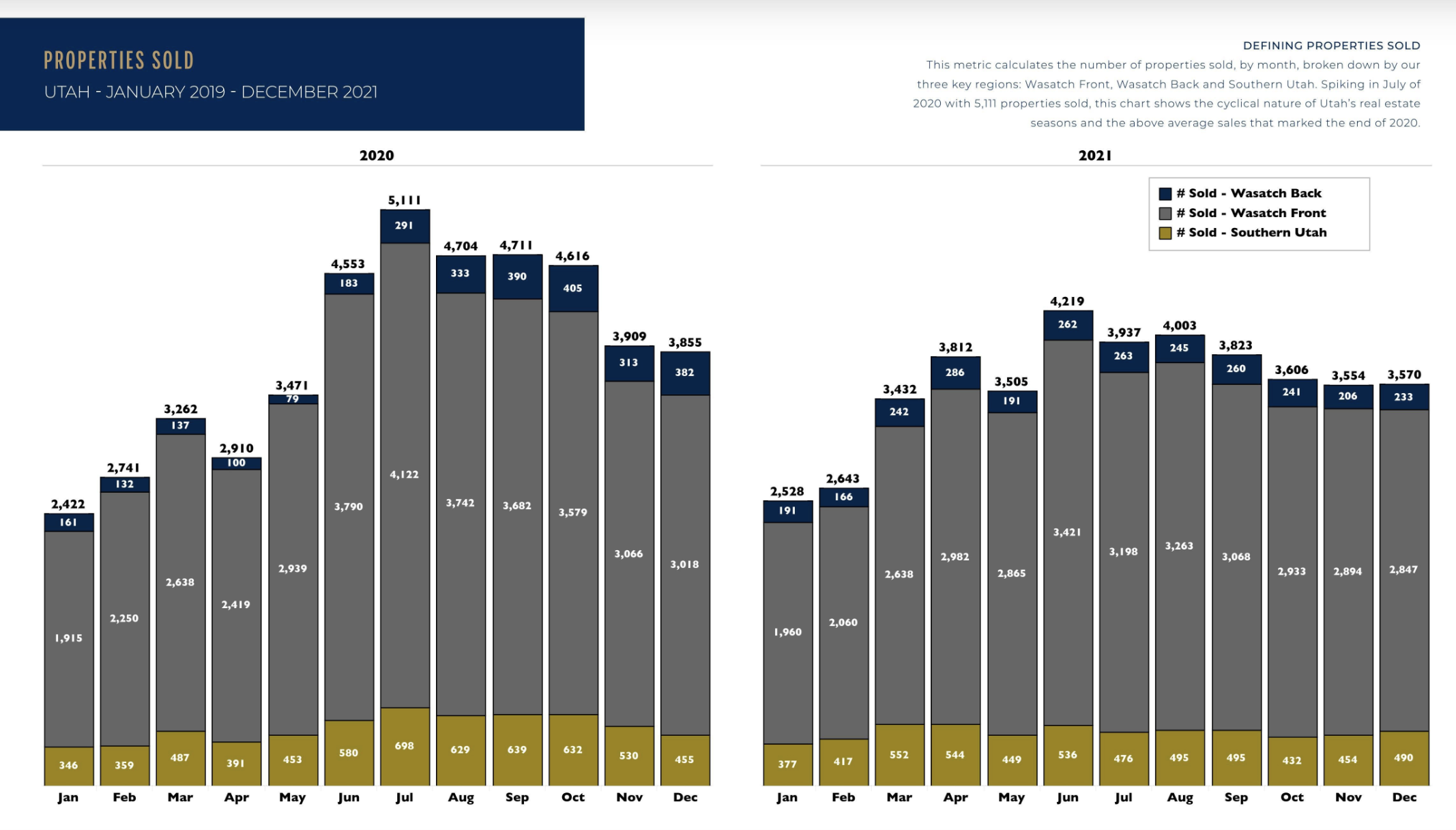

Statewide, housing prices have increased by 27% in 2021. Along the Wasatch Front the average sold price has increased YoY by 25.1% to $570,893, 32.1% in Southern Utah to $577,930, and 39.3% along the Wasatch Back to $2,014,661. The median home price in Salt Lake County has now soared past the half a million mark to $570,893, up 25%. Standing inventory statewide is less than half of what was available in January 2021 (11,396), with December 2020 marking the lowest inventory in two years with only 5,171 properties listed along the Wasatch Front, Wasatch Back, and Southern Utah.

For more in depth information and articles, view the full Market Report here and a Park City market report here.