Town & County

Record number of property tax appeals in 2023 leads to 4% decrease in property values across the county

Photo: TownLift // Rayne Moynahan

SUMMIT COUNTY, Utah – It’ s not surprising that the number of residents who appealed their property taxes last year skyrocketed as tax bills increased significantly. The reason for the hike in people’s bills was that in 2023, Summit County, which includes Park City, conducted a countywide property assessment. This assessment led to significant increases in property values for many homeowners, resulting in higher property tax bills even though the tax rates themselves did not change. The increase in assessed values was a reflection of the rising real estate market in the area.

After it all shook out, the county’s overall taxable value fell about $1.9 billion. The final assessed value however, $48.4 billion, still marks a 40% increase over 2022. The county’s taxable value decreased by more than double the rate of property value decline, primarily due to the 45% tax discount for primary residences and other tax exemptions.

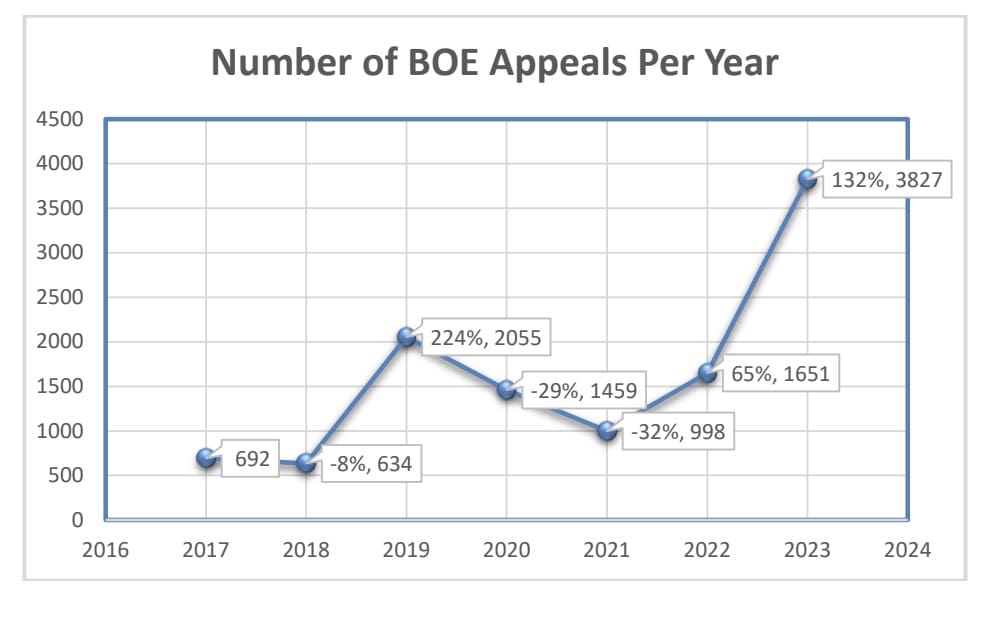

A recent report from the county shows 3,827 Summit County property owners filed appeals with the county auditor in 2023, or about 130% more than in 2022.

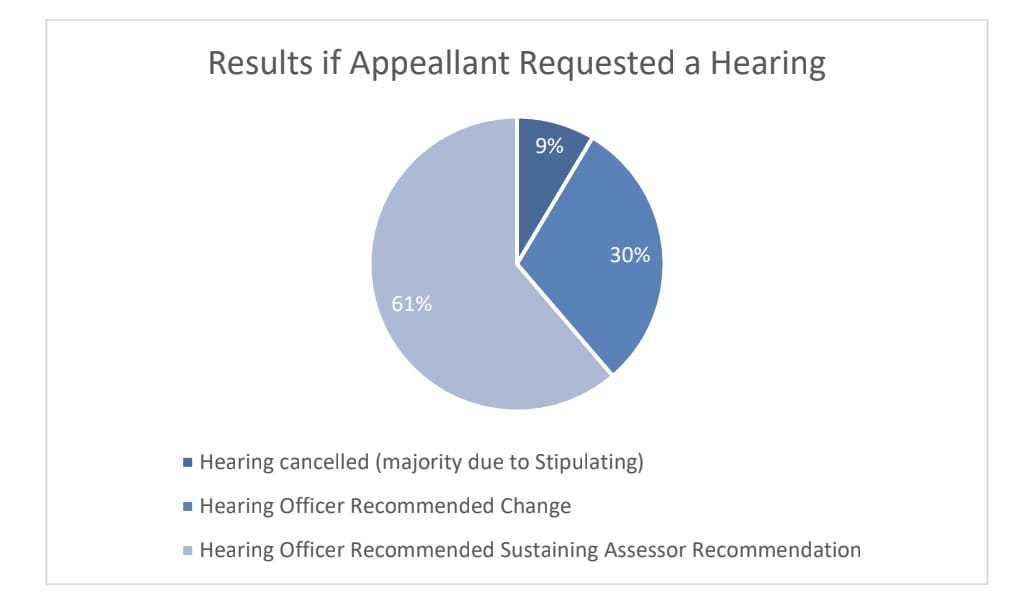

42% of the appeals submitted to the county auditor saw an adjustment in market value, but only 30% of the 442 appeals that resulted in a hearing were changed.

Overall, changes in appealed assessments by the county board of adjustment resulted in an $800,000 decrease in the county’s overall property value.

2023 appeals processed compares to the prior six BOE years. (Summit County Auditor)