Community

Summit County Council approves North Summit Fire District tax increase

The Summit County Council voted yesterday to Photo: North Summit Fire District

SUMMIT COUNTY, Utah —The Summit County Council voted unanimously to approve a 300% tax increase for the North Summit Fire District at its meeting yesterday.

This increase means that property taxes will increase $105 for every $100,000 of a property’s taxable value.

According to a previous Summit County Council report, the last time the North Summit Fire District last went through the truth in taxation process was in 2008, and in 1997 prior to that. This new increase will bring the property tax rate from .00035 to .0014, the North Summit Fire District’s maximum tax rate that was approved by voters in 2007.

According to Summit County’s information page on the tax increase, the primary reason for the increase is to address safety and staffing concerns.

“The proposed tax increase is needed to make sure firefighters and the people they serve are safe and protected,” said the information page. “The National Fire Protection Association has set a standard response time for rural areas of 14 minutes. Response times in North Summit County can be up to 30 minutes, and sometimes more. Currently, the Fire District is limited by resources having only two firefighters on duty, although OSHA federal standards require at least four firefighters be on the scene before entering a structural fire. This is frequently referred to as the ‘2 in-2 out rule’. North Summit Fire District has the lowest ISO rating, a score that reflects how prepared an area is.”

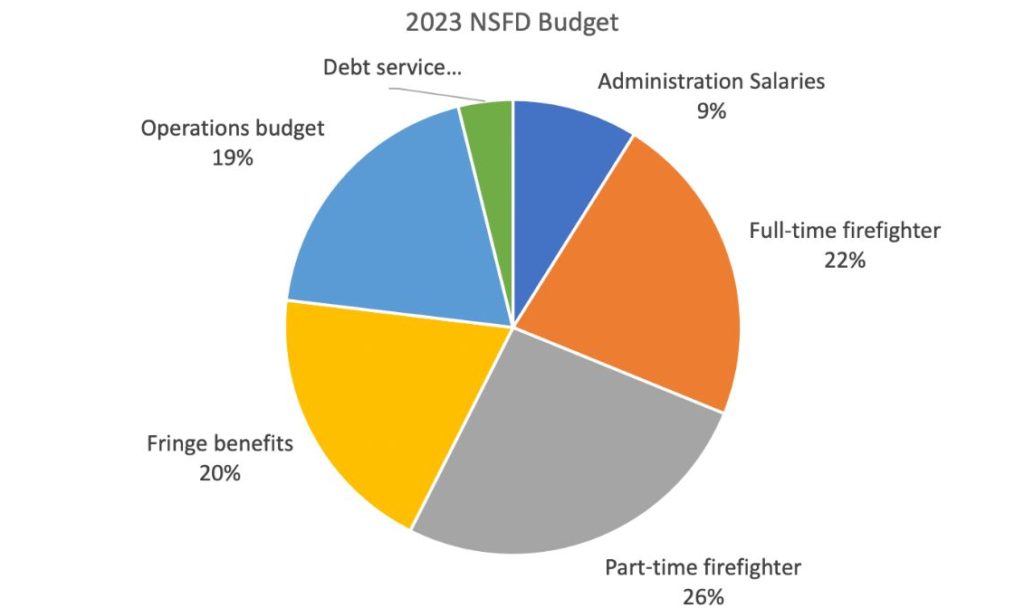

The information page also cites aging equipment and firetrucks as a concern, stating that the protective clothing and self-contained breathing apparatus NSFD firefighters use are more than 20 years past their expected lives. 19% of the North Summit Fire District’s budget for 2023 will go towards operations, 22% will go toward hiring full-time firefighters, and 26% will go toward hiring part-time firefighters.

However, many county residents don’t believe such a large tax increase is necessary to address safety concerns. A public hearing on the tax increase was held at the council’s December 7 meeting, and dozens of residents came from all corners of the county to voice their opinions.

“2007 to 2008 when this was voted on was a completely different time than it is right now,” said Brittany Hammond, a Henefer resident. “You are trying to scare the public… with failing equipment, trucks, buildings, when the fact is the money is going to wages.”

“I know we do need the increase somewhat of a budget to get the fire department up to where it needs to be,” Ray Saunders, a Coalville resident said. “But the mismanagement in the past shouldn’t become a burden on everybody right now, especially with the current economic situation that we’re in.”