Town & County

Summit County Council adopts 1.1% sales tax, moves forward with up to $99 million bond

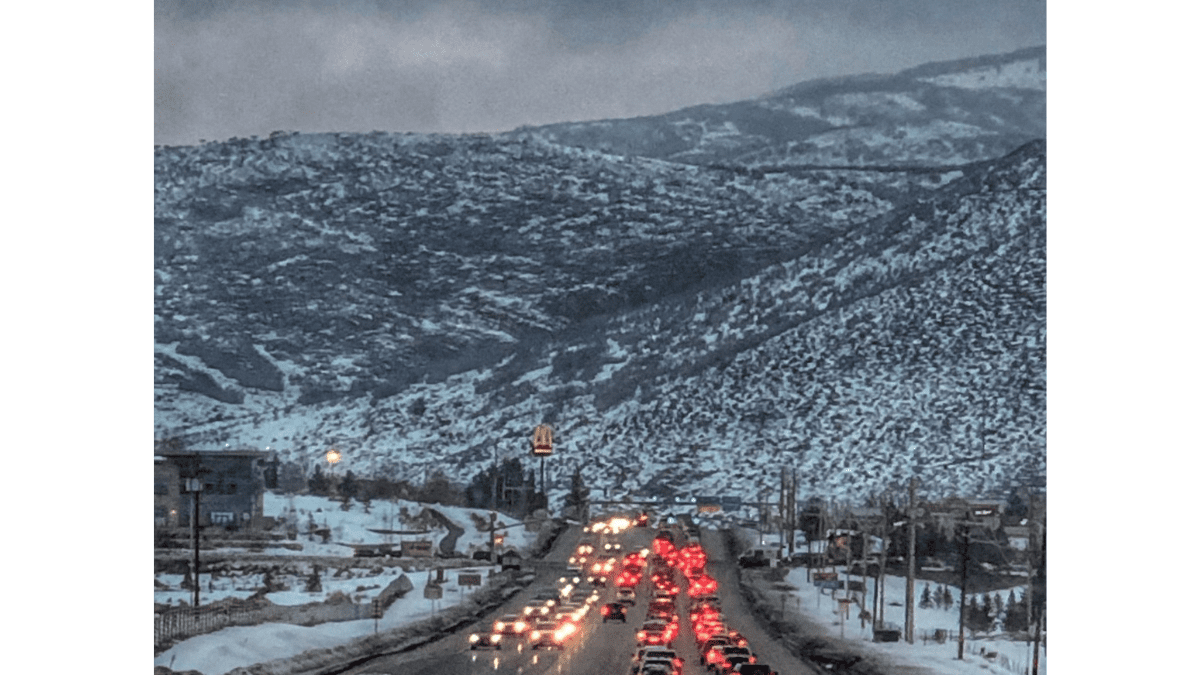

Park City traffic at Kimball Junction. Photo: TownLift

SUMMIT COUNTY, Utah — The Summit County Council on Wednesday approved creating a new 1.1% Impacted Communities sales tax in unincorporated areas and clearing the way for up to $99 million in bonds backed by the revenue. The measure passed 4–1. County Manager Shayne Scott said he expects the tax to take effect in mid-February.

The new tax was passed a year after Summit County voters approved a 0.5% emergency services sales tax and it raises the sales-tax rate in unincorporated Summit County from 7.65% to 8.75%.

The vote came after a presentation on projected revenue, visitor impacts and bond coverage ratios. The council also reviewed Resolution 2025-28, which outlines parameters for issuing sales tax revenue bonds in 2026.

Earlier this year, the Utah Legislature expanded the Impacted Communities Tax Act, allowing third-class counties—including Summit County—to impose the new tax by ordinance. County staff estimate the 1.1% levy will generate roughly $17 million a year, though revenue will vary with tourism, inflation and retail activity.

The tax applies only in unincorporated Summit County. As with last year’s emergency services sales tax, several categories remain exempt, including unprepared foods, prescription medications, gasoline and automobile sales.

Supporters say the county needs the funding and finally has access to a long-sought tool

Council member Chris Robinson said the county has been trying for years to gain access to this type of tax.

“We have resort impacts, same as Park City, but we don’t have this tool,” Robinson said. “I’m very much in favor of it.”

He said the tax could also position the county for a stronger bond rating, potentially lowering interest costs. Staff estimated interest rates between 3.6% and 3.75% based on recent comparable offerings.

Council member Tonja Hanson said the money is needed to address long-standing transportation challenges—not because of the Olympics.

“We’re not looking at implementing this tax because of the Olympics,” Hanson said. “We’re looking at implementing this tax because we have major transportation issues out there that we need to be able to pay for.”

Hanson said she ultimately supported implementing the full 1.1% rate after weighing whether to adopt something lower.

Council member Megan McKenna also backed the ordinance, calling it “an opportunity” and saying the new rate keeps the county competitive with other resort destinations. She said the revenue could support projects like transit centers and Bus Rapid Transit expansions.

“This gives us a much bigger swing with minimal pain,” McKenna said.

One council member objects, citing impacts on basin residents

Council member Canice Hart cast the lone dissenting vote, saying Snyderville Basin residents will “bear the brunt” of another tax increase so soon after the emergency services levy.

“As a representative of District Five, I’m going to be voting against this,” Hart said.

Sales tax rises to 8.75% in unincorporated areas

The new levy raises the sales-tax rate in unincorporated Summit County from 7.65% to 8.75%, or slightly higher in the Kimball Junction transit district, which already collects an additional 0.3% for mass transit. Park City’s rate is 9.55% by comparison.

Staff noted Summit County is unusual statewide: roughly half of all taxable sales occur in unincorporated areas, compared with less than 20% in many other counties.

Bond authorization moves forward

After approving the ordinance, the council discussed Resolution 2025-28, which would authorize issuing up to $99 million in bonds backed by the new tax. The bonding capacity assumes maintaining a two-times debt-service coverage ratio, a key metric for investors.

Several council members said the bonding authority will be critical for major transportation projects, particularly those requiring cost-sharing with the Utah Department of Transportation.