Business

Park City summer lodging tax revenue down nearly 15% as tourism mix shifts

Photo: Inhabit Park City.

Chamber president attributes tax revenue decline to shifting lodging preferences, not a drop in visitation; winter bookings outpacing last year’s

PARK CITY, Utah — Park City collected 14.6% less in lodging tax revenue from May to July 2025 compared to the same period last year, a decline tourism officials attribute to changing visitor lodging preferences rather than a drop in overall visitation.

The city collected $460,735 in transient room tax revenue for the quarter, down $78,512 (-14.6%) from 2024, according to a city budget report. Creating a -9.6% budget deficit for summer lodging tax collections.

Sales tax revenue for the same time frame was more positive posting a 1.8% increase for May – July 2025 compared to the prior year and 6.8% ahead of budget.

Jennifer Wesselhoff, president of the Park City Chamber of Commerce, said the decline on lodging tax revenue stems from changing lodging patterns.

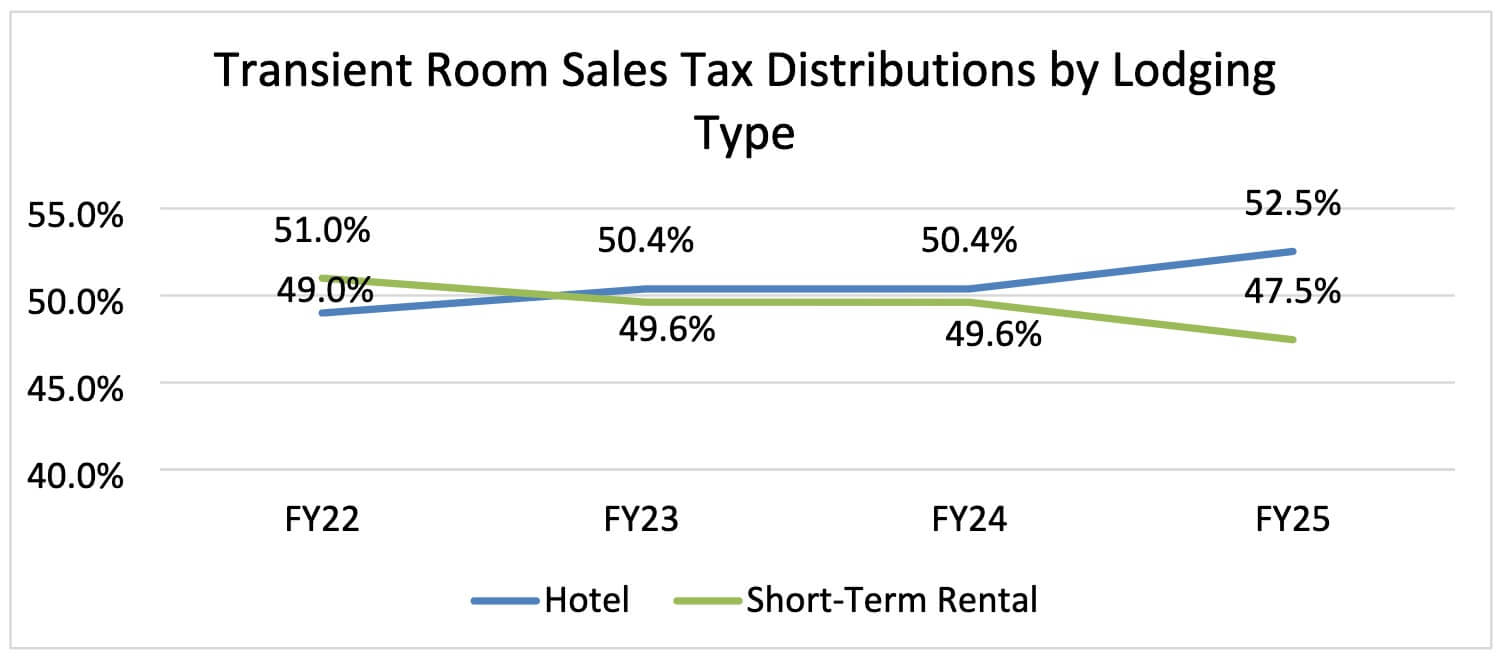

“The recent decline in TRT revenue mainly reflects a shift in lodging mix, not a major drop in visitation,” Wesselhoff said. “We’re seeing fewer short-term rental bookings and a modest increase in traditional hotel stays.”

For the month of July 2025 short-term rental revenue dropped 5.8% while traditional hotel stays rose 2.7%, according to the report. City staff attributed the change to evolving “visitor lodging behavior” that could “temper near-term TRT growth.”

Wesselhoff said short-term rentals typically generate more tax revenue per booking because they often involve full-home rentals with longer stays and higher rates. “So even a small dip in that segment can have a noticeable impact on total TRT collections,” she said.

Other indicators suggest visitors are still spending. September data show local sales tax up 2.2% year-over-year, restaurant tax up 5.3%, and Recreation, Arts & Parks tax up 4.4%.

“These results indicate that visitors are still here and spending robustly, particularly in dining, shopping, and recreation, even as lodging preferences shift,” Wesselhoff said.

Overall July sales tax receipts, excluding lodging taxes, were down 2.4% year-over-year but came in 5% above budget expectations.

Wesselhoff described the trend as “a healthy normalization after several record years,” adding that Park City’s visitor economy “remains strong and diversified.”

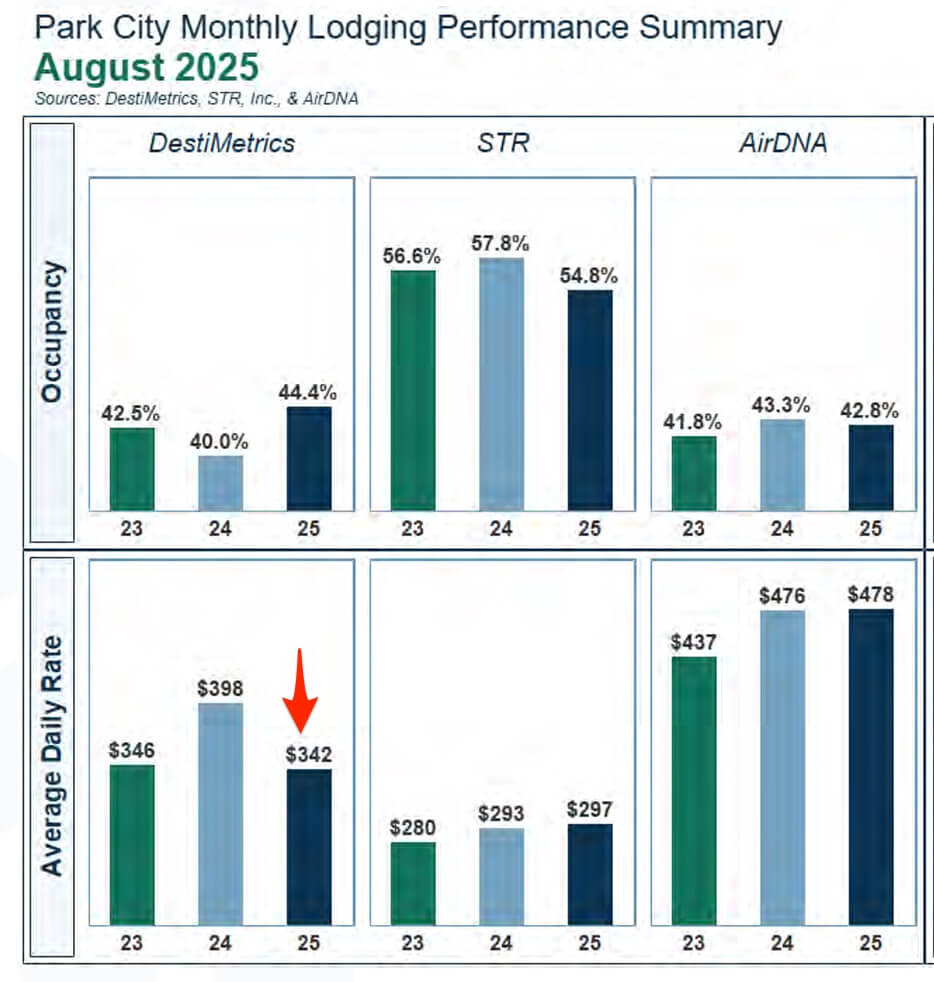

August Average Daily Rate

Summary data from August 2025 shows a 4.4 percent increase in hotel occupancy but a significant drop in the Average Daily Rate (ADR). While the calendar year to date ADR remains mostly flat at $663 in 2025 compared to $662 in 2024, the ADR for August fell to $342, down 14 percent from $398 in August 2024 and below $346 in August 2023. As a result, hotels experienced a 7.5 percent decline in revenue, despite higher occupancy driven by the lower nightly rate.

Winter Lodging Outlook for Park City

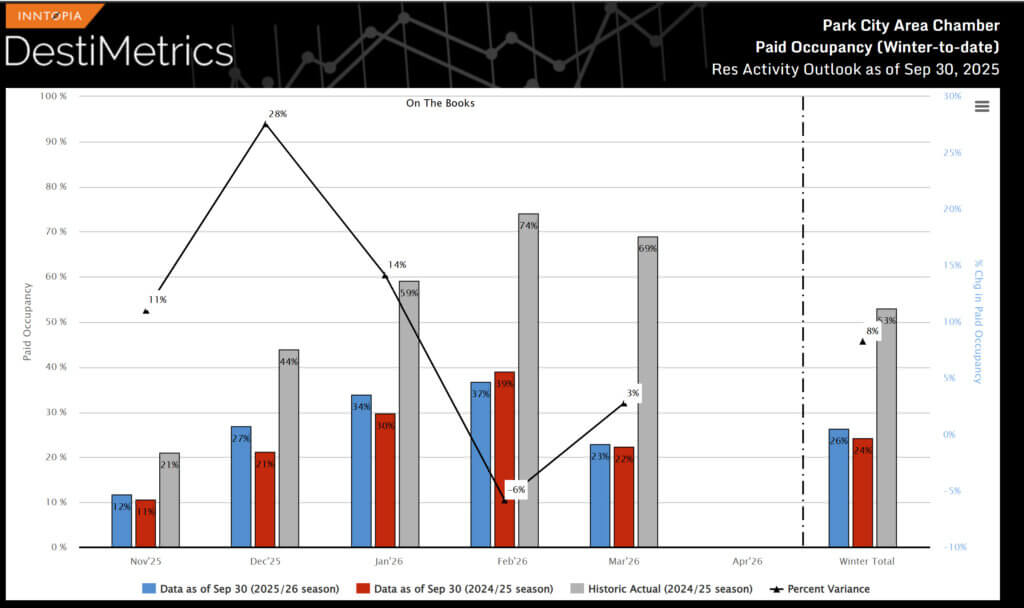

Winter bookings show stronger performance. As of Sept. 30, November reservations are ahead of last year’s pace by 11%, December by nearly 30%, and January by 14%, averaging 8% ahead overall, according to Wesselhoff.

City staff noted in the budget report that August’s preliminary indicators point to “modest” improvement in lodging demand, and that “broad-based strength across the tax base” continues to support the city’s overall budget.