Business

Vail Resorts’ stock hit a 52-week low following planning commission’s decision

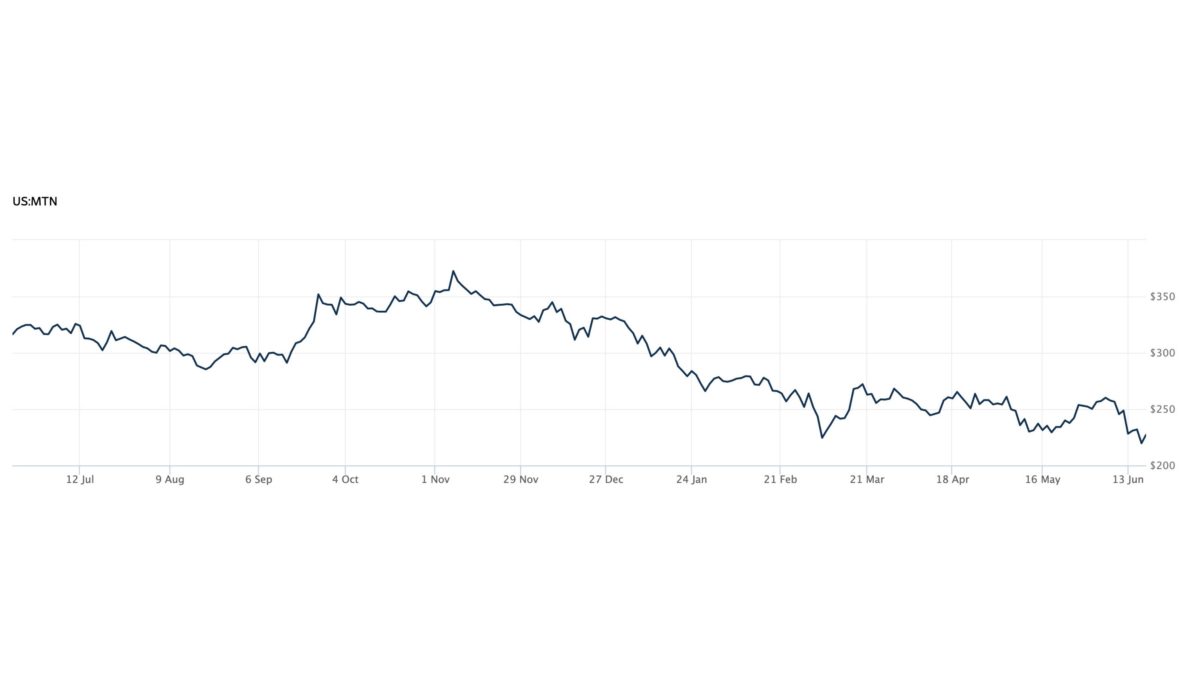

Vail Resorts' stock (MTN) over the past year. Photo: Wall Street Journal

PARK CITY, Utah — A day after the Park City Planning Commission’s decision to grant the appeal of the approved lift upgrades of Eagle and Silverlode at Park City Mountain, resort-owner Vail Resort’s stock (MTN) fell to its lowest level in the past year at $219.69/share.

The company’s stock closed Friday trading at $226.82/share. Year-to-date, MTN’s share price has decreased by roughly 30%.

Vail’s latest financial report showed a roughly 9% increase in pass sales for the 22/23 season compared to the prior year. It also reported fiscal third-quarter earnings per share of $9.16, which was above pre-pandemic levels.

“There’s no question that rising interest rates, high inflation, and the threat of a recession pose risks,” the Motley Fool writes in an analysis of MTN and other resort stocks this week.

“Higher interest rates make things like borrowing for new construction more expensive and will raise the cost of adjustable-rate debt. Inflation, especially fuel prices, is making travel more expensive, and labor costs are rising as they try to hire and hold sufficient staff.”

The Federal Reserve approved a 75 basis point increase on Wednesday, which is the largest rate increase since 1994.

“Though unemployment rates remain low, the prospect of a recession would surely cool off demand for vacation travel, hitting these companies just as they’re recovering from their pandemic slowdowns.”

The S&P 500 fell 5.8% for the week, the largest decline since the pandemic hit markets in March 2020.