Politics

Colorado bill stops allocating lodging tax 100% towards tourism ads

Colorado Gov. Jared Polis enjoying some Colorado Kool-Aid. Photo: Governor Jared Polis

DENVER — Colorado House Bill 22-1117, which was signed by Gov. Jared Polis last month, allows 90% of the state’s lodging tax funds to be allocated towards things that aren’t tourism marketing — such as employee housing, child care, and trail maintenance. Prior to the bill, 100% of those tax funds were spent on tourism ads.

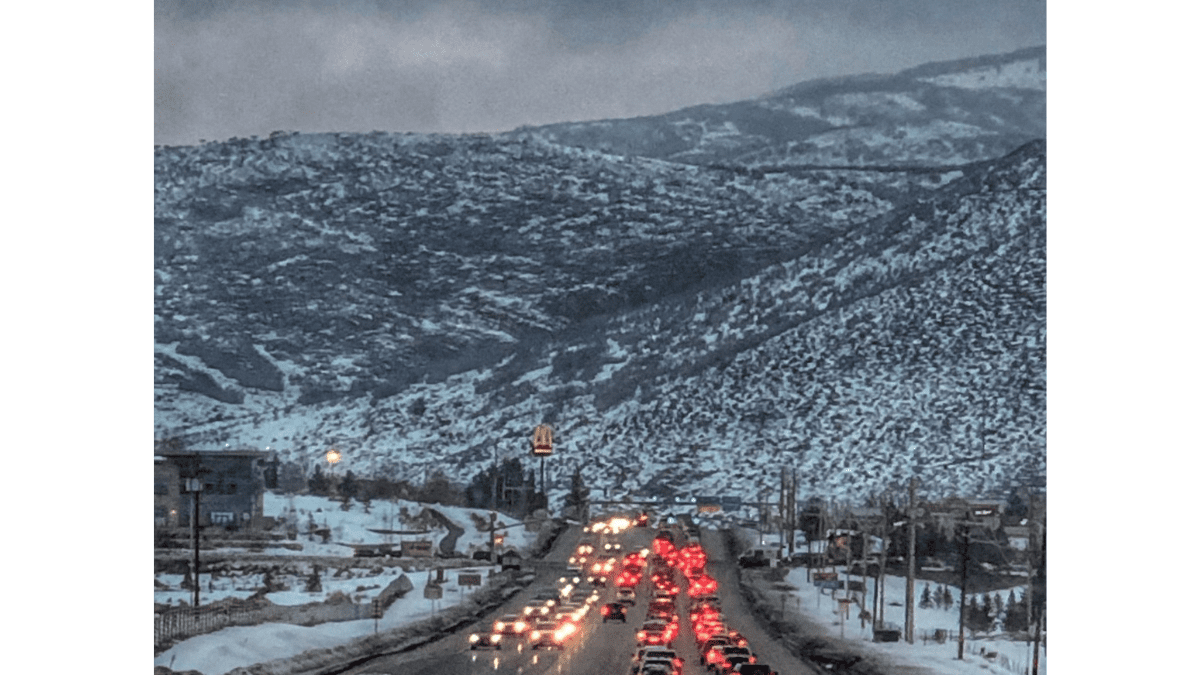

“It was pretty serendipitous timing,” the bill’s sponsor, Rep. Dylan Roberts (D-Avon) told the Vail Daily. “There was a lot of press across the state and the country about some of the impacts of sky-high visitors at any Vail resort across the country.” TownLift had many crowd reports this season regarding Vail Resorts-owned Park City Mountain.

“Communities are healthiest when people who work in communities are also able to live in communities,” Polis said at a press conference, according to the Daily. “It also reduces traffic, takes cars off our roads, leads to cleaner air, and if people can live close to where they work, it also improves employee morale and retention.”

Utah House Bill 323, which Gov. Spencer Cox signed into law in March, allows certain counties to use up to 10% of their transient room tax revenue towards visitor management and mitigating the impacts of tourism. To qualify, counties must be considered a fourth, fifth, or sixth class county, have a population over 9,000, and have a national park within or partially within its boundaries (it was targeted towards Washington County in southwestern Utah).